As with any other investment, diversification is key to the success of your real estate portfolio investment. Diversifying does not mean putting all your eggs into one basket. It means finding a balance between reward and risk. You can diversify your portfolio by investing in different types and locations. Diversification might include buying and renting another property. This strategy is proven to bring in high profits for many investors. Learn more about real estate investment.

Building a real estate portfolio

Depending on your goals, building a real estate portfolio should include a mix of smart investments that generate cash flow. A portfolio could contain properties that are safe, have potential for growth, and are easy to manage. The exact formula will depend on your risk tolerance and personal goals, but these steps can help build a portfolio that meets those goals. Here are some suggestions for building a real-estate portfolio.

Building a real estate portfolio is just like any other business. Find a buyer and arrange financing. You may also need funding to purchase your next investment property. This is easier if you have a detailed business plan. If you build a realty portfolio, it will make it easier to make informed decisions about the worth of each property. You will also need to plan how to finance your different properties.

Tokenization for real estate

Tokenization of real estate portfolio investment is an option for businesses that have real estate property located in progressive jurisdictions. Tokenized property investment allows the investors to have ownership of the real-estate, which is often a income-producing asset. The real estate security token holders can decide how to distribute the income. Smart contracts allow investors to make these decisions automatically, reducing transaction costs and time. Tokenization of real-estate portfolio investment requires that a realty security be located in a country that has strong private property rights protection laws. This makes it difficult for other countries to have the same legal framework.

Many investors are currently holding real estate through timeshare schemes. Tokenization offers flexibility to both owners and investors, and lowers the traditional inliquidity of real property. Real estate investors can also invest more easily with tokens than in traditional investment avenues, thanks to the blockchain technology behind it. Tokenization could be a good option if you're looking to invest in real-estate.

Calculating the return on your real-estate investments

There are many factors to consider when you calculate the return on your real estate portfolio investment. You will make a difference in the value of your property, including its condition, financing terms and market conditions. You should set a realistic goal, monitor your investments closely and be clear about what you are investing in. If your ROI is not what you expected, you may need to revise your strategy.

The inflation rate is an important factor when calculating the ROI on a real estate investment. While real estate can provide stable returns, REITs could produce volatile returns. The capitalization ratio (CAPR), which measures investment performance, can be used to determine it. This figure is calculated using an investor's net operational income over a one-year period and divided by the current property value. This information is helpful when comparing properties with similar capitalization rate.

Multi-tenant rental properties are an investment opportunity

Multiple rental properties can help you diversify your real-estate portfolio. It is possible to generate multiple streams from the same property. This can prove beneficial in uncertain economic times. But this strategy may prove difficult to finance. Here are some tips to get started. Do some research before you invest. Get to know the market.

Take into account your savings ability. Before you invest in a rental property, you must have sufficient cash to cover a 20% downpayment. Experts in rental property management recommend that you have a cushion of cash to purchase multiple properties. This is particularly important if you intend to purchase multiple properties. If you purchase a new property within two to three years of the one you have, you might have enough cash to pay your monthly expenses.

FAQ

What should I look out for in a mortgage broker

A mortgage broker assists people who aren’t eligible for traditional mortgages. They look through different lenders to find the best deal. Some brokers charge fees for this service. Others offer no cost services.

How much money do I need to purchase my home?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

How can you tell if your house is worth selling?

If your asking price is too low, it may be because you aren't pricing your home correctly. If your asking price is significantly below the market value, there might not be enough interest. You can use our free Home Value Report to learn more about the current market conditions.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

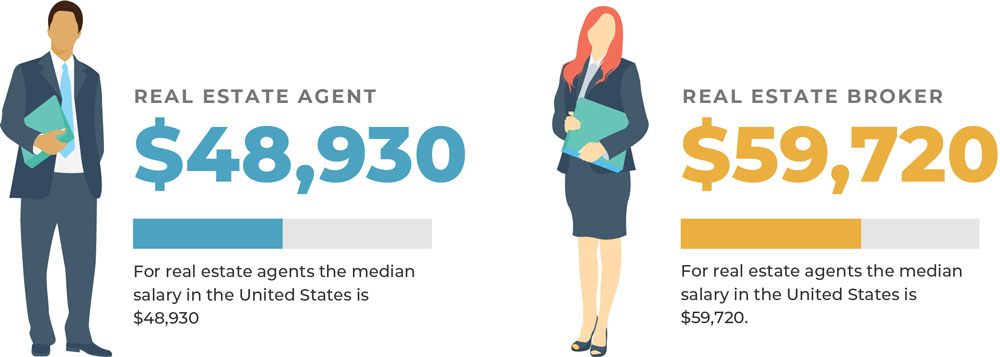

How to become a real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This means that you will need to study at least 2 hours per week for 3 months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

These exams are passed and you can now work as an agent in real estate.