Toby Salgado hosts Super Agents Live. This podcast offers a wealth of information and tips for all types of real estate agents. The most popular episode of the podcast is "The Biggest Loser," which is a must listen for any business that is in decline. This episode features Sean Moudry (a mega-agent with a strong resume and a charming demeanor), who is a real estate star.

A large portion of attendees are aspiring real estate agents, as you might expect. Real estate can be daunting. However, with the right amount of hard work and a healthy dose of luck, you can build a thriving practice. It's half the fun to make new friends.

There are many things to keep in mind while navigating the treacherous real estate maze. It is a good idea, first of all, to have an effective strategy. This includes identifying key players and putting them in touch. It's crucial that everyone stays on the same page. Sometimes, it can even be a game-changer in a company. A hierarchy of leadership is also a good idea to guide your scalawags up the ranks. Similar to the previous, it's not a good idea to make your agents work too hard.

A well-planned strategy will help you to deal with clients and colleagues. This will make a big difference in your bottom line. To stay competitive, you need a well-designed office. It is essential to have a designated space that has plenty of desk space, and a comfortable chair for your clients.

Last but not least, don't lose your cool. Being proactive about your mental health is key to surviving stressful real estate work. You should first look for a reputable firm if your goal is to find a new home. Next, hire a professional for help. While you're at it, try to take the stress out of your clients' lives as well. You'll be rewarded for keeping your clients happy, and your sanity intact.

You may even end up becoming a real-estate mogul. Take the time to hone your skills, learn about the industry, and you'll be the envy of the neighborhood.

FAQ

What's the time frame to get a loan approved?

It depends on several factors such as credit score, income level, type of loan, etc. It usually takes between 30 and 60 days to get approved for a mortgage.

Do I require flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood insurance here.

Can I get another mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is used to consolidate or fund home improvements.

What are the downsides to a fixed-rate loan?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. Additionally, if you decide not to sell your home by the end of the term you could lose a substantial amount due to the difference between your sale price and the outstanding balance.

Should I use a mortgage broker?

A mortgage broker is a good choice if you're looking for a low rate. A broker works with multiple lenders to negotiate your behalf. Some brokers receive a commission from lenders. Before you sign up, be sure to review all fees associated.

How much will my home cost?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

How can I get rid of termites & other pests?

Over time, termites and other pests can take over your home. They can cause severe damage to wooden structures, such as decks and furniture. This can be prevented by having a professional pest controller inspect your home.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to be a real-estate broker

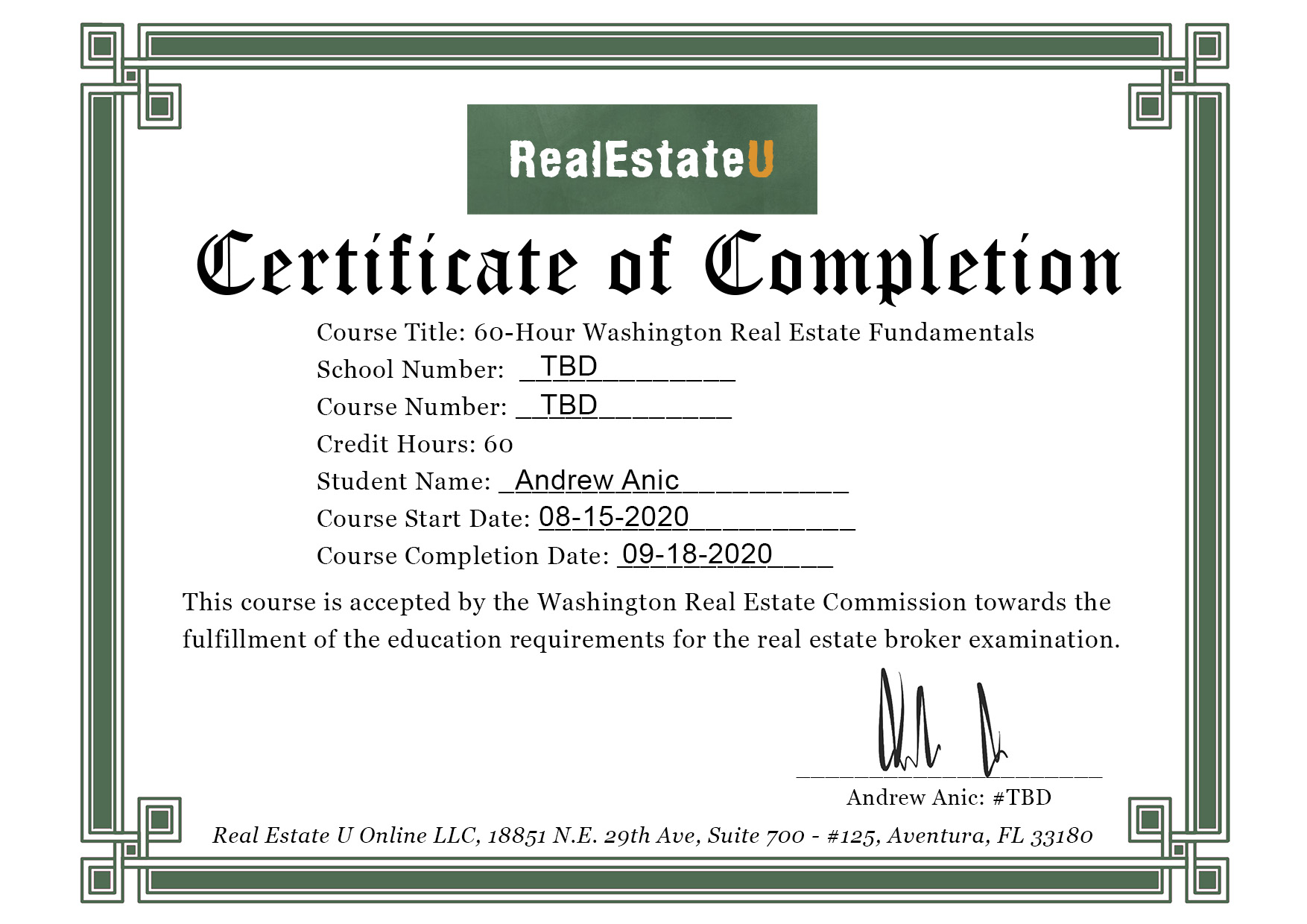

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

All these exams must be passed before you can become a licensed real estate agent.