You can't go wrong when you hire a real estate professional, whether you're selling or buying a home. They are invaluable for buyers and sellers as well as being a resource for advice. They may be able provide you with the inside scoop on your area's procedures.

In a typical transaction, an agent will charge the buyer a commission. It usually ranges from five to six per cent of the home's price. In its most basic form, the fee splits between the listing agent of the buyer and the buyer's representative. Additional closing costs may be required depending on the state.

Smart about how you pay your realtor fees is the best way to avoid paying too much for a house. A seasoned agent won't be offended if you ask for a reduction. There are other ways to save money, such as looking for a discount real estate agent.

Over the past several years, the real estate market has experienced a variety of new business models. These services typically include flat-fee list services that place a house on the MLS. These agents can help you save thousands of dollars over the long-term.

Real estate is competitive. Many agents want to lower their fees to win bidding wars. This may be an opportunity for some agents to offer discounts. It is a good idea for anyone considering moving to find out what they are up against before you begin the process.

The average American homeowner will make $56,700 more equity in the 3rd quarter 2021. Although this isn't much, if you plan to sell your house in the next few weeks, it's worth taking advantage of every opportunity. A home selling for $200,000 will average, while a commission of five percent will run you over three thousand dollars.

Although you may not think of a realty agent when you are looking to buy or sell your home, their value cannot be underestimated. Some properties are relatively easy to sell, others can take months of work. A realtor can help you find the right house for you and determine the price.

A good Realtor can give you an accurate estimate of the commission they charge, what they will and will not charge, and how willing they are to negotiate. They can also give you information on local procedures, including who is required to have a home inspector and what the legal jargon looks like.

The most important part of a realtor's job is to provide you with the information you need to make a good decision. They're not obligated to act in your best interest, but they will if they think they can do so. You might even be able to work with them to negotiate a better deal.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. You may also lose a lot if your house is sold before the term ends.

What are the benefits to a fixed-rate mortgage

A fixed-rate mortgage locks in your interest rate for the term of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

How much money do I need to save before buying a home?

It depends on how much time you intend to stay there. It is important to start saving as soon as you can if you intend to stay there for more than five years. However, if you're planning on moving within two years, you don’t need to worry.

What is a reverse loan?

A reverse mortgage lets you borrow money directly from your home. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types to choose from: government-insured or conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance covers repayments.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to become an agent in real estate

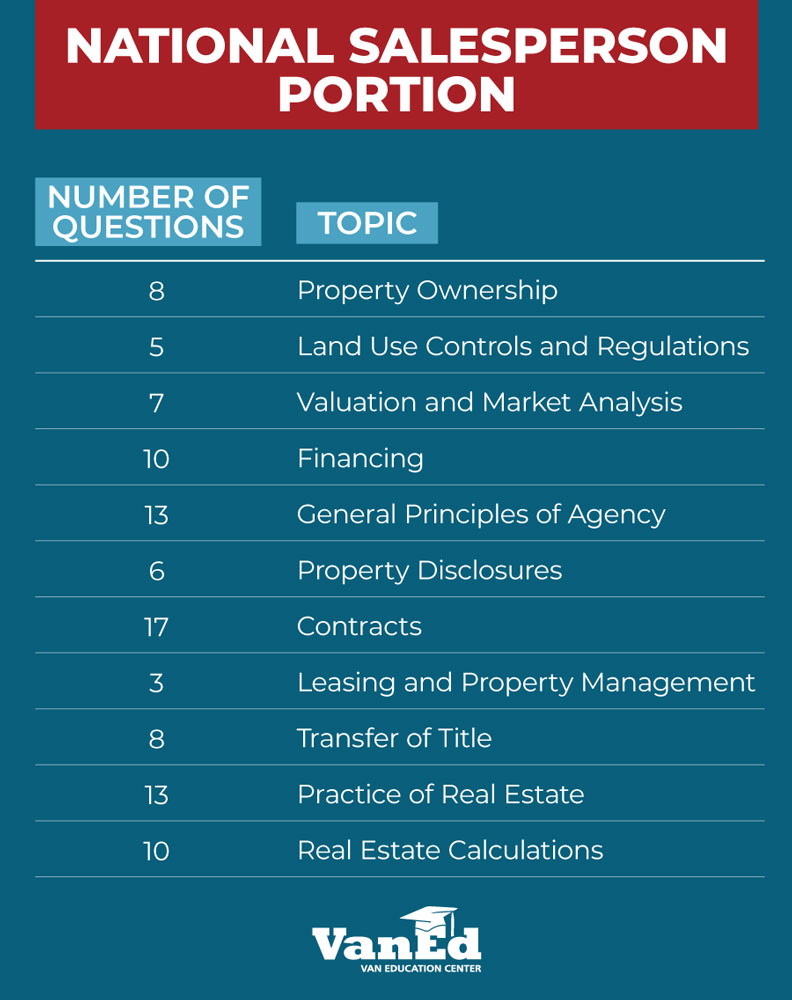

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

Once you have passed these tests, you are qualified to become a real estate agent.